- Contact Us

Secure your legacy with structured planning and long-term wealth protection

Ensures your assets are distributed according to your wishes, minimizing legal hassles and disputes.

Helps reduce estate and inheritance taxes through smart structuring and planning.

Protects your family’s long-term interests with structured plans for succession and asset management.

Protecting and growing your family’s wealth with strategic, long-term planning.

Centralized tracking and management of all family assets for better financial control.

Strategic planning to protect wealth against market volatility, taxation, and unforeseen events.

Ensures long-term wealth preservation and growth across generations through informed decision-making.

Creating harmony and clarity through structured decision-making and conflict resolution frameworks.

Establishes clear roles, rules, and communication channels to reduce misunderstandings within the family.

Facilitates structured leadership transitions and long-term continuity of family values and business.

Encourages collaboration, shared vision, and accountability across generations.

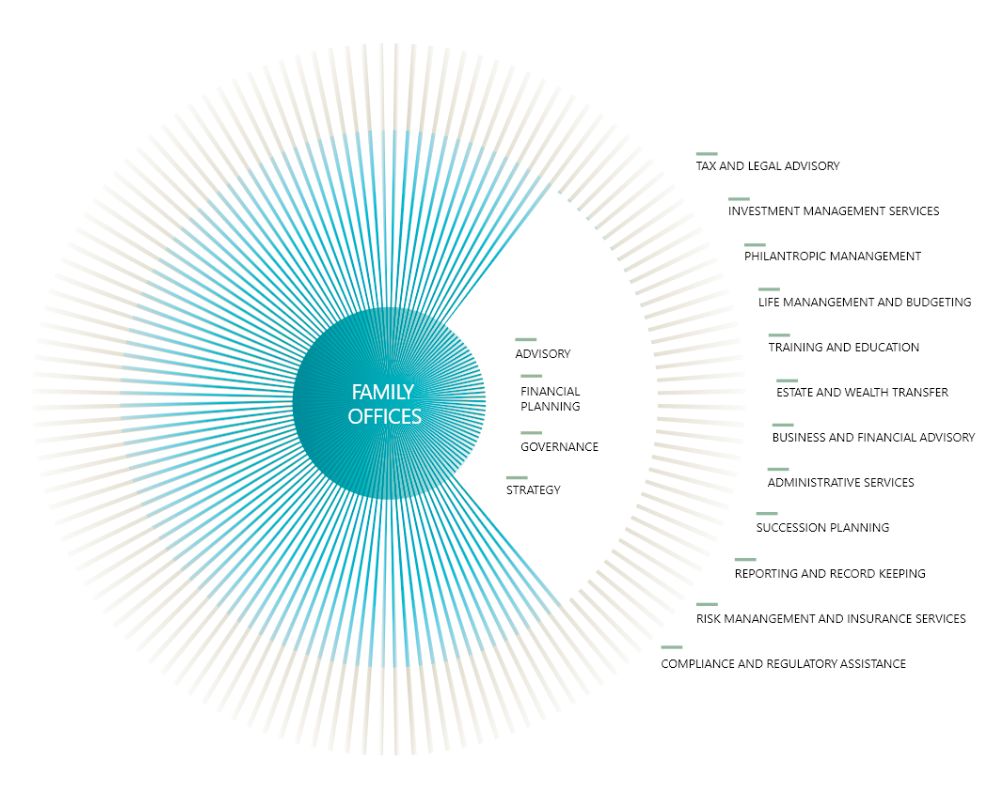

We offer a comprehensive suite of estate planning and family office services tailored to the unique needs of high-net-worth individuals and families. We emphasize the importance of structured wealth transfer and management, ensuring your assets are protected, optimized, and seamlessly passed on across generations. With a strong focus on a multi-generational wealth preservation approach, our experts guide you through will creation, trust structuring, tax strategies, and family governance—empowering your legacy to thrive well into the future.

Estate planning for HNIs includes creating wills, setting up trusts, structuring assets for tax efficiency, planning succession, and ensuring smooth transfer of wealth across generations. It’s a strategic process tailored to your family’s goals and complexities.

A family office provides centralized financial management, including investment oversight, wealth preservation, compliance, and governance. It brings structure, transparency, and long-term planning to help families manage wealth efficiently and sustainably.

Yes, we provide end-to-end support in setting up trusts, HUFs, and Special Purpose Vehicles (SPVs) that align with your wealth transfer, asset protection, and succession objectives—while also complying with relevant tax and legal requirements.

Absolutely. We work with a network of legal and tax experts to offer specialized solutions for NRIs, including offshore structuring, repatriation planning, and estate strategies that align with both Indian and international regulations.

Stay updated with the latest financial insights, regulatory updates, and smart money tips—delivered straight to your WhatsApp.

We’re here to support your financial journey—reach out anytime!

Website Developed by Hashtag Consultancy

Copyright © 2025 | AccrueWealth Finserve LLC | All rights reserved.

WhatsApp us